Why you should invest

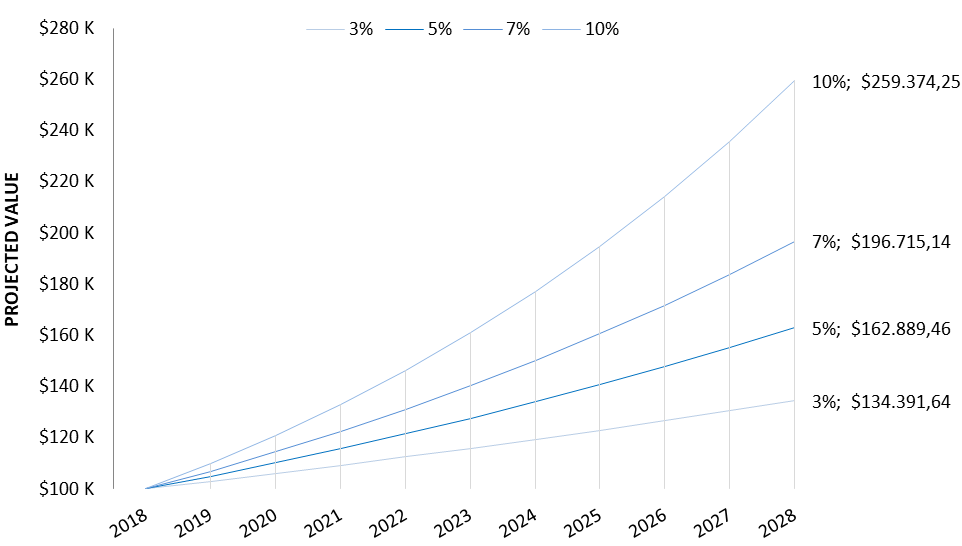

If you had invested in a diversified portfolio with an average annual return of 7% in the last 10 years, you could have doubled your capital.

Declaration of Disclosure

The potential growth chart is a tool that hypothetically shows how the value of your account could be impacted in the long term, in a scenario where it is recurrently invested and subject to market changes.

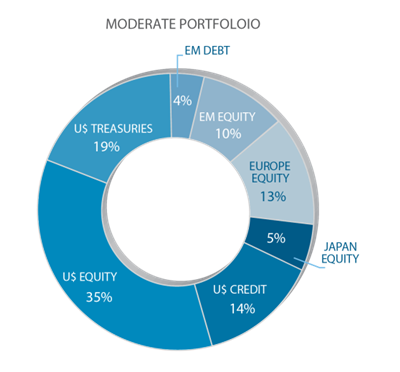

We manage your portfolios using models designed by BlackRock, one of the world’s largest asset management firm**. To achieve the highest fiscal efficiency, portfolios are built with UCITS ETFs that accumulate profits. UCITS ETFs are registered in Europe; therefore, they provide important tax benefits for investors who do not reside in the U.S. Moreover, the investor can withdraw money without any type of restriction or cost.

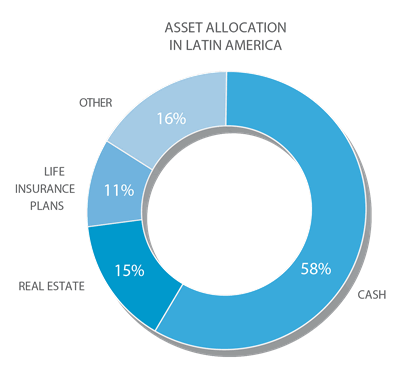

Although most of us would agree the best long-term strategy would be to invest globally, at least 60% of Latin Americans have more than two thirds of their savings in cash. We offer a diversified strategy. Throughout history, we see repeatedly confirm that asset class selection is the outmost contributor to overall portfolio performance.

**At our discretion, we may elect to deviate from any models provided by BlackRock.

In Latin America, people tend not to invest their money. On the other hand, those who decide to invest, concentrate all their assets in one country.

The problem in having all your savings in the same type of asset is that it generates: high volatility, uncertainty, return instability and in some cases low liquidity.

Diversification is the most efficient way to reduce portfolio risk by investing in assets that are not highly correlated with each other.

The main goal is to improve the relationship between risk and return.